Condo Insurance in and around Mount Horeb

Welcome, condo unitowners of Mount Horeb

Insure your condo with State Farm today

- Mount Horeb

- Cross Plains

- Madison

- Black Earth

- Mazomanie

- Verona

- Middleton

- Ridgeway

- Mount Vernon

- Spring Green

- Blue Mounds

- Arena

- Lodi

- Hollandale

- Blanchardville

- Dodgeville

- Lone rock

- Fitchburg

- Sauk City

- Prairie du Sac

- Merrimac

- Dane County

- Iowa County

- Sauk County

Home Is Where Your Condo Is

Because your condo is your home base, there are some key details to consider - size, home layout, needed repairs, and making sure you have the right protection for your home in case of the unexpected. That's where State Farm comes in to offer you quality insurance options to help meet your needs.

Welcome, condo unitowners of Mount Horeb

Insure your condo with State Farm today

Protect Your Condo With Insurance From State Farm

With this protection from State Farm, you don't have to be afraid of the unexpected happening to your condo and its contents. Agent Jim Dietzen can help lay out all the various options for you to consider, and will assist you in creating a wonderful policy that's right for you.

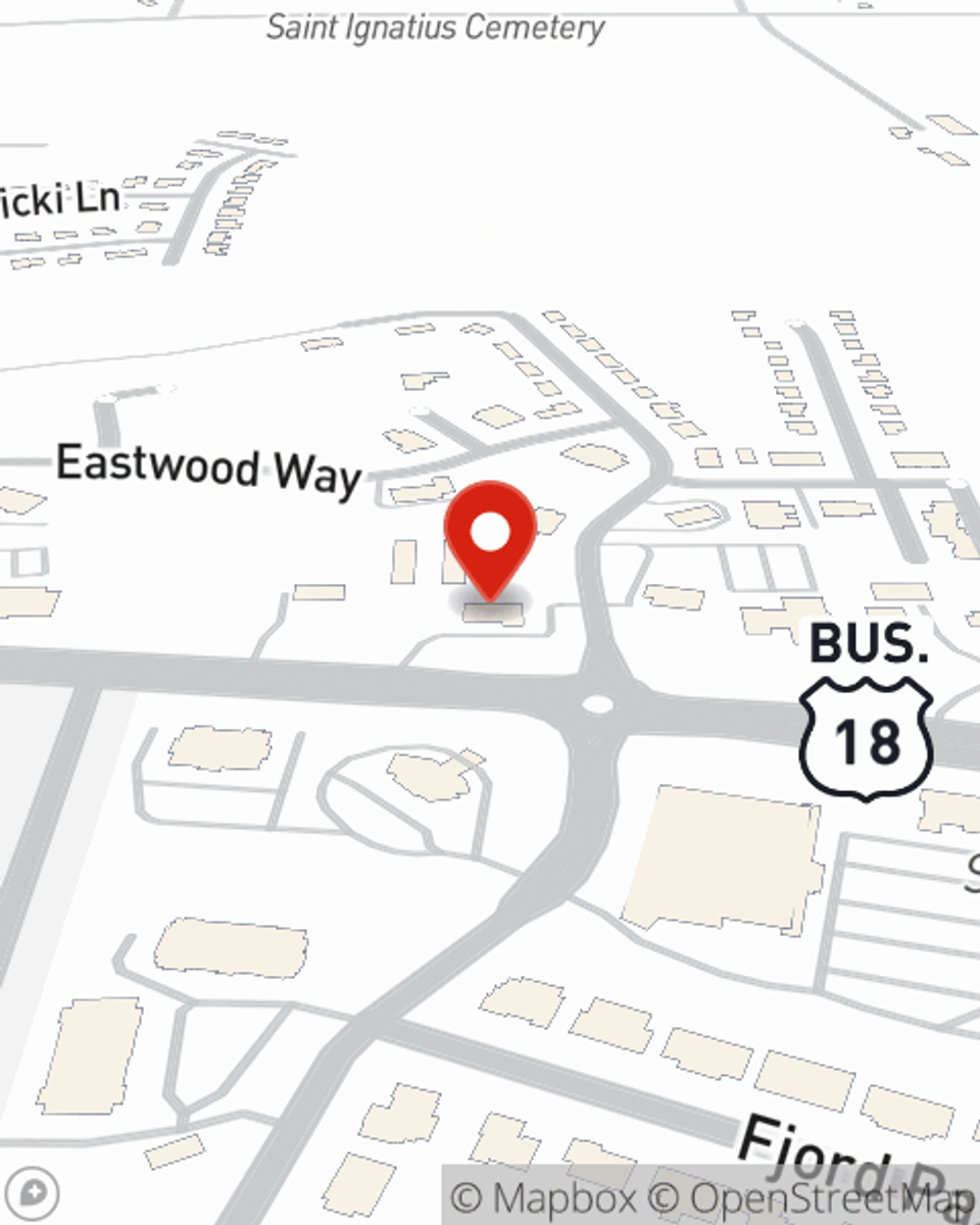

Mount Horeb condo owners, are you ready to discover what the State Farm brand can do for you? Call or email State Farm Agent Jim Dietzen today.

Have More Questions About Condo Unitowners Insurance?

Call Jim at (608) 437-4400 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Jim Dietzen

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.